08/14/2025

Insurance Claims for Roof Damage: Step-by-Step Process Guide

Dealing with roof damage can be overwhelming, especially when you’re facing the complex world of insurance claims. Whether it’s storm damage from hail, wind, or fallen trees, or gradual deterioration that’s finally caught up with your roof, understanding the insurance claims process is crucial for protecting your home and your financial investment. Many homeowners find themselves unprepared when disaster strikes, unsure of their rights, responsibilities, and the steps they need to take to ensure their claim is processed fairly and efficiently.

The insurance claims process for roof damage involves multiple stages, from initial damage assessment to final settlement, and each step requires careful attention to detail. Knowing what to expect, how to document damage properly, and when to seek professional help can make the difference between a successful claim that fully covers your repairs and a frustrating experience that leaves you paying out of pocket.

This comprehensive guide will walk you through each stage of the process, providing you with the knowledge and confidence you need to navigate your roof damage insurance claim successfully.

Immediate Steps After Discovering Roof Damage

The first moments after spotting roof damage are crucial for your safety and for protecting your insurance claim. Always make the safety of your family your top priority and take steps to prevent further harm to your property. If you notice active leaking, place buckets or tarps to catch water and protect belongings from moisture. Never climb onto a damaged roof, as this can be dangerous and may worsen the damage. Acting quickly and safely will help you manage the situation effectively.

- Ensure Safety First: Check that everyone in your home is safe and away from areas directly impacted by the damage. Use tarps or buckets to control leaks, but avoid attempting repairs yourself in unsafe conditions.

- Document the Damage: Take clear photos from multiple angles, both outside from the ground and inside if you see water stains or sagging ceilings. These images will be key when filing your insurance claim.

- Use Time-Stamped Photos: Confirm your camera or phone settings show the correct date and time before taking pictures. This detail helps validate when the damage occurred for your insurer.

- Report the Claim Promptly: Contact your insurance company right away using their 24/7 claims hotline if available. Have your policy number and a detailed description ready to speed up the process.

Following these steps not only protects your home but also strengthens your insurance claim. Acting promptly shows you are taking the matter seriously, which can make the claims process smoother. Being prepared with documentation and clear details helps your insurer address the issue faster.

Understanding Your Insurance Policy Coverage

Before you start the claims process, it’s important to know exactly what your homeowners insurance policy covers for roof damage. Standard policies usually cover sudden and accidental damage caused by perils like hail, wind, fire, or falling objects. They often exclude issues from gradual wear, poor maintenance, or weather events such as floods or earthquakes. Knowing these details helps you set realistic expectations for your claim and avoid surprises.

- Know Your Covered Perils: Check if your policy includes protection for events like hail, wind, fire, or falling objects. Be aware that floods, earthquakes, and wear-related damage are typically excluded.

- Review Your DeductibleL Understand the amount you must pay out-of-pocket before your insurance covers the rest. This may be a set dollar amount or a percentage of your home’s insured value, especially for wind and hail claims.

- Understand Depreciation TermsL Learn whether your policy pays based on “actual cash value” or “replacement cost.” The first deducts for depreciation, while the second covers repairs without that deduction.

- Contact Your Insurance AgentL If you’re unsure about any coverage details, reach out to your agent or company representative. They can clarify what’s included and help you prepare before filing a claim.

Being familiar with these aspects of your policy helps you make informed decisions when roof damage occurs. You’ll be better equipped to determine if filing a claim is worthwhile and to anticipate your potential payout. This knowledge can also speed up the claims process and reduce stress along the way.

Documenting Damage for Your Insurance Claim

Thorough documentation is the foundation of a successful insurance claim. Your record should include photographs, written descriptions, and weather reports from the day the damage occurred. When photographing, take both wide shots to capture the overall scope and close-ups to highlight specific problem areas. Including reference points like rulers or common objects in your photos can help demonstrate the scale of the damage.

- Take Clear Photographs: Capture wide-angle shots for context and close-up images for detail. Use objects like rulers to show scale and make the extent of the damage clear.

- Keep Detailed Written Records: Note the date, time, weather conditions, and specific areas affected. Update these notes if new damage appears, recording each change separately.

- Gather Weather Reports: Obtain official weather data from sources like the National Weather Service. These reports can confirm the conditions that caused the damage and strengthen your claim.

- Follow Proven Examples: A client who faced major hail damage in 2023 documented over 100 photos, kept detailed notes, and secured weather reports. Their thorough records led to a full replacement settlement, including upgraded impact-resistant Class 4 shingles.

By following these steps, you create a solid foundation for your insurance claim. Detailed evidence not only supports your case but can also influence a higher settlement amount. Proper documentation can make the difference between a partial payout and a full repair or replacement.

Working with Insurance Adjusters

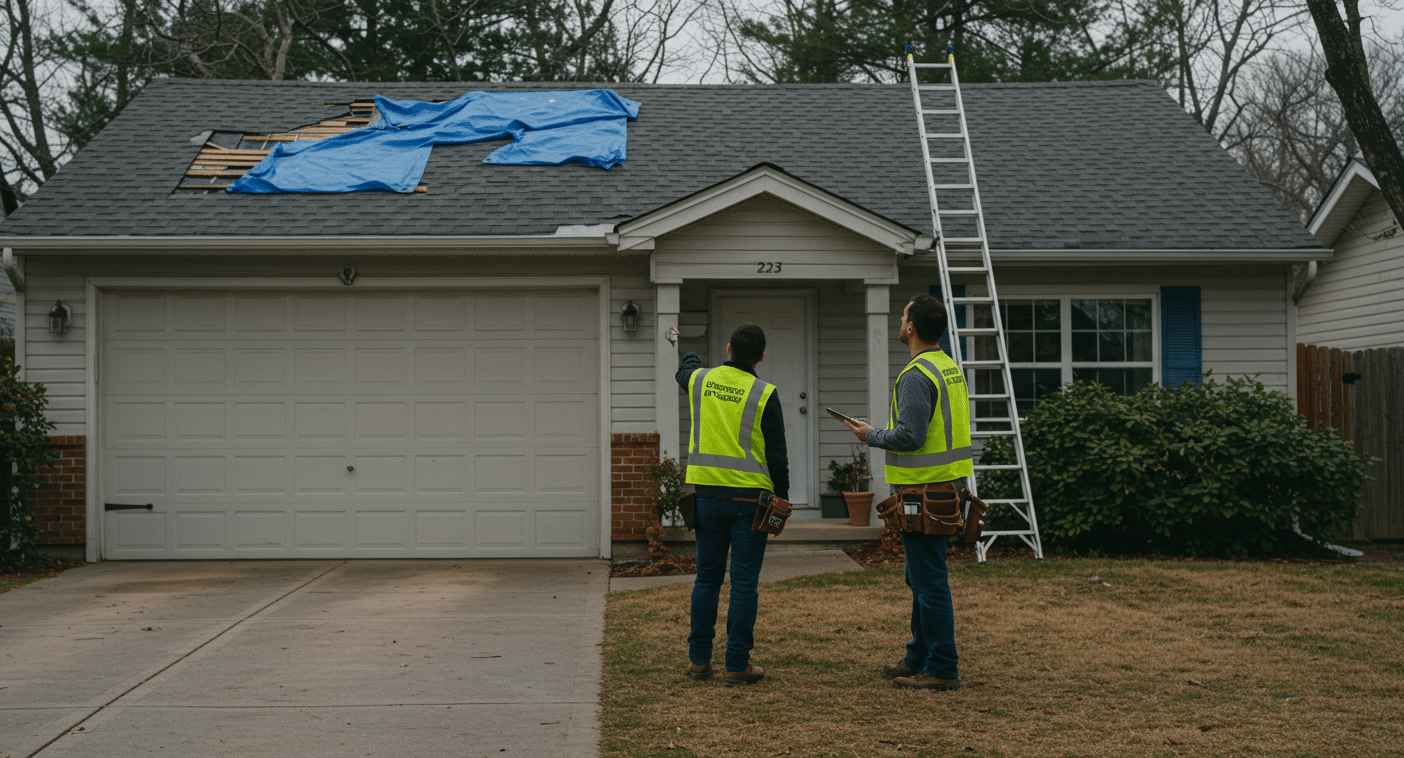

Your insurance company will assign an adjuster to evaluate your claim and inspect the roof damage. This representative determines the extent of covered damage and the settlement amount you may receive. Knowing how to work effectively with the adjuster can greatly influence your claim’s outcome. By being prepared and engaged during the process, you can help ensure that no critical details are overlooked.

Here are key steps to take when working with your insurance adjuster:

- Organize Your Documentation: Have all photographs, written records, and weather reports ready before the inspection. This preparation shows you are thorough and helps the adjuster verify your claim quickly.

- Be Present During the Inspection: Walk with the adjuster as they review the damage and ask questions about their findings. Take notes during the meeting and request copies of their report and any photographs they take.

- Point Out All Damage: Don’t hesitate to show areas you believe were affected, even if they seem minor. Adjusters can miss certain spots, and these details may increase your settlement amount.

- Seek a Second Opinion if Needed: If you disagree with the assessment, request another inspection or hire a public adjuster or contractor. An independent evaluation can provide leverage if the original settlement is too low.

Professional roofing contractors from Veteran Brothers Roofing & Restoration can assist during this process. Their expertise can help identify overlooked damage and ensure all affected areas are properly documented for a fair settlement.

Common Challenges and How to Overcome Them

Insurance claims for roof damage often encounter several predictable challenges. One of the most common issues is the insurance company’s attempt to attribute damage to normal wear and tear rather than a covered peril. To combat this, maintain detailed records of your roof’s maintenance history and age. If your roof is relatively new or well-maintained, this strengthens your argument that damage resulted from a specific covered event rather than gradual deterioration.

Another frequent challenge involves disputes over the extent of damage or the need for full roof replacement versus partial repairs. Insurance companies often prefer to authorize repairs to individual sections rather than complete replacement, even when a full replacement would be more appropriate. Professional assessments can help demonstrate when partial repairs are insufficient or when matching existing materials is impossible due to age or discontinuation.

Claim delays represent another significant challenge, particularly during busy storm seasons when adjusters are overwhelmed with claims. Stay in regular contact with your insurance company and document all communications. If delays become excessive, contact your state’s insurance commissioner’s office, which can help expedite the process. Keep detailed records of any additional damage that occurs due to delays in repairs, as this may be covered under your policy’s additional living expenses or loss of use provisions.

The following strategies can help overcome these common challenges:

- Maintain comprehensive documentation throughout the process

- Seek professional evaluations from qualified roofing contractors

- Understand your policy rights and coverage limits

- Communicate regularly with all parties involved

- Be prepared to escalate disputes when necessary

Professional Assistance and When to Seek Help

While homeowners can manage many parts of the insurance claims process, certain situations call for professional support. Hiring the right experts can make a significant difference in the outcome of your claim. Public adjusters, roofing contractors, and insurance attorneys each bring unique skills to the table. Knowing when to involve them can help you avoid costly mistakes and secure a fair settlement.

Here are key professionals who can assist you during the claims process:

- Public Adjusters: If your claim is large, complex, or you’re uncomfortable negotiating, a public adjuster can represent your interests. They work for you, handle the paperwork, and aim to maximize your settlement.

- Roofing Contractors: Licensed and insured contractors experienced with insurance claims can identify all damage, including hidden issues. They also ensure repairs meet local codes and permit requirements.

- Insurance Attorneys: If your claim is denied, settlement talks stall, or you suspect bad faith, an attorney can help protect your rights. Understand their fee structure and weigh it against the potential additional settlement.

- Roof Age and Condition Experts: Knowing the age and condition of your roof, including how long different roof materials typically last, can help in determining the cause of damage. This information can distinguish between covered perils and normal wear and tear.

Bringing in the right professionals at the right time can greatly improve your chances of a successful claim. Their expertise can uncover overlooked damage, ensure accurate documentation, and help you navigate negotiations with confidence.

Finalizing Your Claim and Moving Forward

Once your insurance company approves your claim, it’s important to review the settlement offer in detail before agreeing to it. Make sure all identified damage is included and the amount is sufficient to cover the full cost of necessary repairs. If the settlement includes depreciation, understand when and how you will receive the recoverable portion after the work is completed. Taking the right steps now ensures your repairs are done properly and your claim is fully resolved.

Here are the key actions to take after your claim has been approved:

- Review the Settlement Offer: Confirm that every area of documented damage is accounted for in the settlement. Make sure the payment covers the complete repair cost and clarify the process for receiving any recoverable depreciation.

- Get Multiple Contractor Quotes: Obtain estimates from licensed and insured roofing contractors with insurance claim experience. Ensure their written bids align with the scope approved by your insurer, and avoid any contractor who offers to waive your deductible.

- Maintain Detailed Repair Records: Keep copies of contracts, permits, invoices, and progress photos during the repair process. These records may be required for final insurance payments and will be valuable for future claims or when selling your home.

- Consider Strategic Upgrades: Explore options like impact-resistant roofing or improved ventilation systems that may prevent future damage and reduce insurance premiums. Some upgrades may require extra out-of-pocket costs but can provide long-term savings and protection.

Following these steps helps ensure repairs are completed to code, your claim is fully honored, and your home is better protected for the future. Taking the time to document and plan carefully can also improve your home’s value and durability.

Frequently Asked Questions

How long do I have to file an insurance claim after discovering roof damage?

Most insurance policies require you to report claims “promptly” or within a “reasonable time” after discovering damage, typically within one year. However, it’s best to report claims as soon as possible after discovery.

Some states have specific statutory requirements, and delayed reporting can give insurance companies grounds to deny your claim. Check your policy language and state laws for specific timeframes.

Will filing a roof damage claim increase my insurance premiums?

Filing a claim may affect your premiums, but the impact varies by company, your claims history, and the cause of damage. Weather-related claims are generally viewed more favorably than claims resulting from negligence or lack of maintenance.

Some insurers offer claim forgiveness programs for first-time claimants or long-term customers. Consider the claim amount versus potential premium increases when deciding whether to file.

Can I choose my own roofing contractor, or does the insurance company assign one?

You have the right to choose your own contractor for repairs. Insurance companies may recommend contractors, but they cannot require you to use specific providers. Obtain multiple quotes and choose a contractor based on reputation, licensing, insurance, and experience with your type of roofing system. Ensure any contractor you choose is properly licensed and insured.

What should I do if my insurance company denies my roof damage claim?

If your claim is denied, request a detailed explanation in writing specifying the policy provisions or exclusions cited for the denial. Review your policy carefully and consider obtaining an independent professional assessment of the damage. You can appeal the decision through your insurance company’s internal process, file a complaint with your state insurance commissioner, or consult with an attorney specializing in insurance claims.

How can I prevent disputes over the extent of roof damage with my insurance company?

Thorough documentation is key to preventing disputes. Take comprehensive photos and videos from multiple angles, maintain detailed written records of all damage, and obtain weather reports from official sources. Consider hiring a professional roofing contractor to provide an independent assessment and detailed estimate. Having professional documentation strengthens your position and reduces the likelihood of disputes over the scope of necessary repairs.

Get the Support You Need for a Successful Roof Insurance Claim

Navigating insurance claims for roof damage requires preparation, documentation, and persistence, but understanding the process empowers you to protect your interests and secure fair compensation. From the immediate steps after discovering damage to working effectively with adjusters and overcoming common challenges, each stage of the process builds toward a successful outcome.

Remember that thorough documentation, professional assistance when needed, and clear communication with all parties involved are your strongest tools for achieving a favorable settlement. Don’t hesitate to seek help from qualified professionals when the stakes are high or when you’re facing resistance from your insurance company, as their expertise can often make the difference between a partial settlement and full compensation for your roof damage.

About Veteran Brothers Roofing & Restoration

Veteran Brothers Roofing & Restoration specializes in residential and commercial roofing services with over 15 years of experience serving homeowners and businesses throughout the region. We provide comprehensive roofing solutions including storm damage restoration, insurance claim assistance, roof repairs, and complete roof replacements. Our team of certified roofing professionals combines technical expertise with extensive knowledge of insurance claim processes to help clients navigate complex situations and achieve optimal outcomes.

We pride ourselves on our military-grade attention to detail and commitment to excellence, offering services that include emergency roof repairs, hail and wind damage restoration, and preventive maintenance programs. Our experienced team has helped over 5,000 clients successfully navigate insurance claims while delivering superior craftsmanship and customer service. We work directly with insurance adjusters and understand the documentation and processes required to support successful claims.

Contact Veteran Brothers Roofing & Restoration today at (817) 875-9834 to discuss how our roofing and insurance expertise can help you protect your property and navigate the claims process effectively. Schedule a consultation to learn more about our comprehensive roofing services and how we’ve helped clients achieve successful insurance claim settlements while ensuring their homes are properly protected.

INCOMING MESSAGE

It’s storm season. If you think there’s been storm damage to your roof, or would simply like the peace of mind of knowing you’re in the clear, Veteran Brothers is here to help.